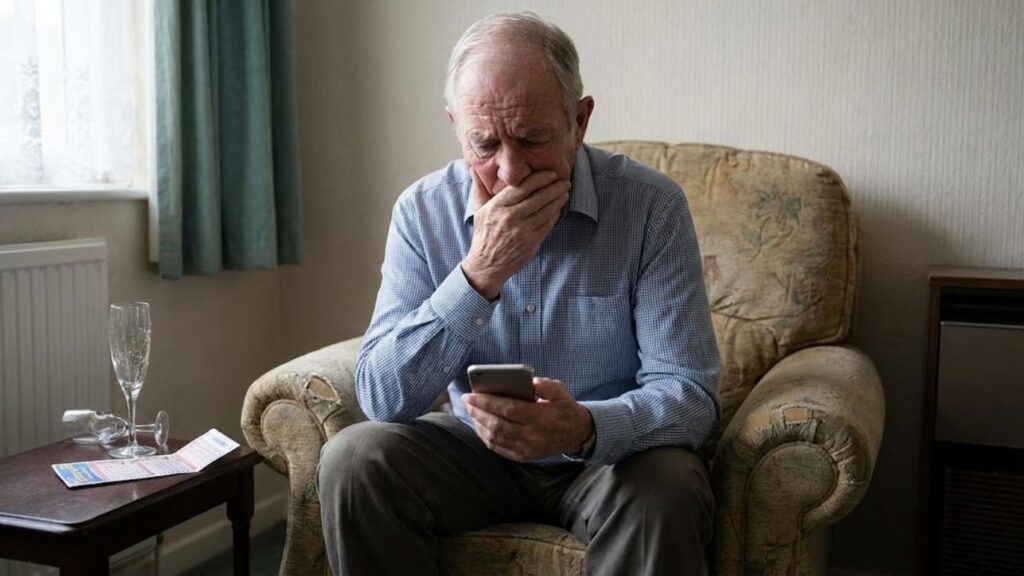

On a Tuesday morning, Jean, a 68-year-old retired electrician, sipped coffee from his chipped white mug, oblivious to the fact that his world had just shifted. The number displayed on his phone’s screen was so large that his brain refused to process it. €71,500,000. He blinked twice, checked the date, and checked again. The lottery app displayed its confetti animation as though such winnings were an everyday occurrence.

Jean called his daughter, his hands trembling so much he had to sit down on the vinyl chair his late wife had chosen. The call was filled with laughter, tears, and dreams of a new life: a house by the sea, paying off debts, a new car. For a few hours, life felt endless.

But seven days later, that same phone displayed a far less exciting number: €0.00.

A Life-Changing Win Gone in an Instant

The story Jean lived through feels like a cruel urban legend, but it’s entirely real. The €71.5 million was confirmed—Jean was the official winner. For a few short days, he walked through his neighborhood as if the sky had chosen him. People said he seemed different, his pockets constantly checked as if the fortune might suddenly jingle like loose coins.

He couldn’t sleep, his mind racing with thoughts of new floors, new furniture, a completely different life. “You look different, Jean,” said a neighbor at the bakery. He smiled, overwhelmed by the absurdity of it all, the reality of his new life appearing through a simple phone notification.

But no one had warned him—what happens after the win is often the real game. Jean’s story took a sudden turn with a seemingly innocent prompt on his smartphone. A request to confirm his account details. A minor security warning asking him to log in and update his bank information before the funds were transferred. Just a simple, unremarkable pop-up we typically dismiss while distracted by something else.

Trusting the familiar logo and interface, Jean followed the instructions. He typed, validated, and followed through with the app that had just made him a multimillionaire. Hours later, a sophisticated scam network, using a cloned interface, had quietly drained his €71.5 million through a series of well-orchestrated transfers into foreign accounts.

The Calm Before the Storm

The shock didn’t arrive with flashing alarms or midnight knocks at his door. It came quietly: an unusual email from the lottery operator saying they couldn’t finalize the payment. Then a call from his bank about “unusual activity.” By the time Jean realized something was terribly wrong, his app no longer displayed his massive win—just a technical error.

The following days became a blur of phone calls, meetings, and silence. His daughter searched through every message and notification. “Where did you click, Dad? What exactly did you do?” The lottery operator confirmed that the attempt had been registered, but the funds were no longer in Jean’s account. On paper, he was still a winner. In reality, he was poorer than ever, his fortune swallowed by a single tap.

The New Face of Cybercrime

Police explained to Jean’s family that the fraud was part of a growing trend: scammers targeting lottery winners through fake apps, phishing links, and cloned interfaces. It wasn’t complex hacking but rather social engineering that targeted retirees, those less familiar with fast-evolving digital risks. Jean’s win had opened a door to his greatest vulnerability—one that many players still overlook.

A Simple Tap That Can Wipe Out a Fortune

Cybercrime units constantly remind the public of one golden rule: never follow a link to an app. Always find it yourself in the official store. While this may seem tedious, it’s crucial. Investigators believe a fake link, posing as an app update, arrived via SMS almost simultaneously with Jean’s official win notification. One led to the legitimate lottery app, the other to a flawless replica that captured his bank login and ID information.

The scam was nearly flawless. No obvious red flags, no spelling errors, no obvious signs of fraud. Just a professional-looking interface asking Jean to “validate” his identity to release his funds. In his emotional state, he clicked through without hesitation. The excitement clouded his judgment, and he trusted the familiar logo. It was easy to overlook the risks when imagining a life of luxury.

For Jean, this was a lesson in vulnerability. He had never been taught to recognize digital risks, focusing more on physical dangers like slips and falls than on virtual ones. It’s a painful irony that the fortune that could have brought him security instead led him straight into the hands of cybercriminals.

Simple Actions Could Have Prevented It

Experts advise that every new lottery winner, large or small, should take a simple step: disconnect for 24 hours. Avoid impulsive clicks, app updates, or new downloads. Take time to write down details about the communication you’ve received, who contacted you, and what they’re asking. Then, contact the lottery operator directly using the official contact details from your ticket or their website.

Another simple precaution: dedicate a single device to all your banking and high-stakes apps. A device you don’t share, don’t use for casual browsing, and don’t clutter with random apps. A cleaner device makes it harder for fake apps or links to slip through unnoticed.

The key to avoiding scams is resisting the pressure to act quickly. Fraudsters thrive on creating a false sense of urgency: “Confirm within 24 hours.” “Last chance to secure your prize.” These tactics prey on the emotional highs of winning, creating panic that leads to compliance. The antidote is simple: stop, breathe, and talk it through with someone you trust.

Cybersecurity experts advise saying the message out loud, as if you were explaining it to someone else. Often, the absurdity of the situation will become immediately apparent. If an app suddenly demands your bank logins, ID photos, and a video of your face in minutes, that’s not a prize—it’s a trap.

Protecting the Vulnerable

Fraud experts worry not just about the money lost, but about the lasting effects on trust. People like Jean start to distrust every screen, seeing every app as a potential threat. This is why it’s crucial to support vulnerable relatives and help them understand the risks of digital life. A simple rule for families: “If something huge appears on your phone—good or bad—don’t answer it alone.” It’s a small habit that could save a fortune.

Key Tips for Protecting Yourself and Loved Ones

- Never install or update lottery apps via SMS or email links—always go to the official app store yourself.

- Take 24 hours before acting on any unexpected lottery win notifications and consult a trusted person.

- Use a separate device for banking and high-stakes apps to minimize risk.

- For family members who aren’t tech-savvy, explain the basic digital safety rules to prevent them from falling victim to scams.

- If in doubt, contact the lottery operator directly using the official phone number.

These small, simple steps can prevent scams and ensure that a win doesn’t lead to an even greater loss.