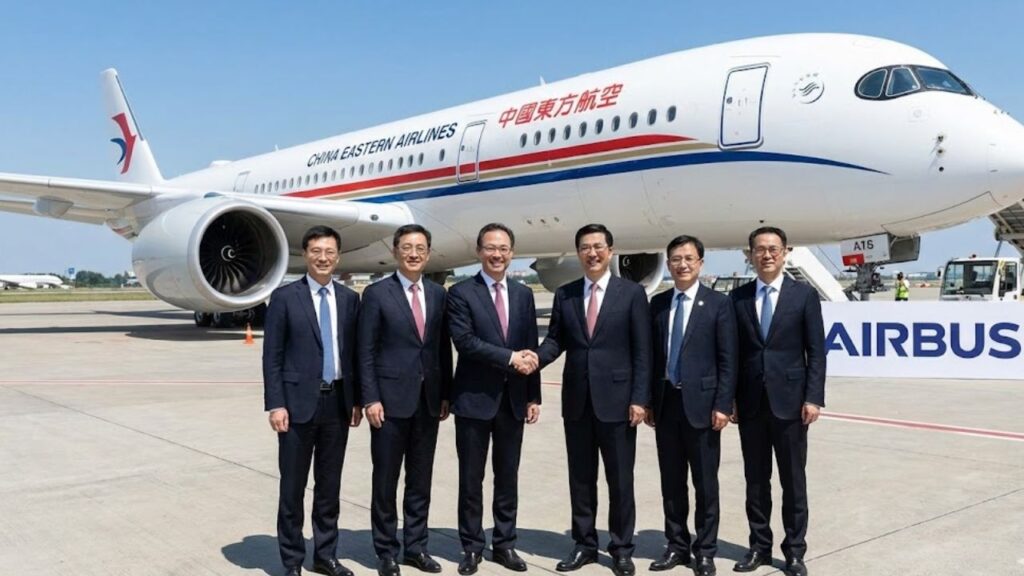

China’s aviation sector has delivered another headline-making moment as a fresh Airbus order reinforces confidence in the global aircraft leasing industry. The deal arrives at a time when leasing is becoming central to airline expansion, particularly in fast-growing markets like China, where carriers prefer flexibility over outright ownership. With forecasts placing the aircraft leasing market at €370 billion by 2032, this development highlights how strategic orders can reshape credibility, financing confidence, and long-term planning for manufacturers and lessors operating in one of the world’s most competitive aviation environments.

Airbus order from China strengthens aircraft leasing confidence

The latest Chinese order has sent a strong signal across the leasing ecosystem, underlining Airbus’s growing trust among global lessors. For leasing firms, such commitments reduce uncertainty and improve asset attractiveness, especially when backed by large state-linked airlines. This order reflects market confidence, reinforces long-term demand, and supports fleet expansion plans across Asia. Lessors view these moves as validation that narrowbody and widebody aircraft will retain value over extended lease cycles. In practical terms, it improves financing terms, lowers perceived risk, and strengthens Airbus’s position as a preferred manufacturer for portfolios aimed at emerging and mature markets alike.

China-driven Airbus momentum reshapes leasing market outlook

China’s influence on aviation finance is hard to ignore, and this Airbus deal adds momentum to a sector already on an upward curve. Leasing companies increasingly align strategies with Chinese growth patterns, seeing them as anchors for stable returns. The order highlights regional growth drivers, encourages capital inflows, and boosts portfolio stability for global lessors. As airlines manage capacity cautiously, leasing offers flexibility without heavy balance-sheet exposure. Airbus benefits by embedding its aircraft deeper into leasing pools that circulate globally, ensuring sustained demand even during economic slowdowns or traffic fluctuations.

Aircraft leasing market expansion supported by Airbus credibility

As projections point toward a €370 billion leasing market by 2032, credibility has become a decisive factor. Airbus’s success in securing large Chinese orders enhances its standing among financial institutions and lessors alike. This credibility supports competitive lease rates, enables risk diversification, and strengthens global supply chains. For lessors, aircraft backed by consistent manufacturer demand are easier to place and refinance. The ripple effect benefits airlines seeking modern fleets, investors chasing predictable yields, and manufacturers aiming to secure long-term production stability.

Why this Airbus-China deal matters long term

Beyond headline numbers, the importance of this order lies in how it aligns manufacturing strength with leasing dynamics. China’s continued engagement reassures stakeholders that demand fundamentals remain intact. It highlights strategic partnerships, supports industry resilience, and underpins future valuations across leasing portfolios. As the market scales toward its projected size, deals like this help set benchmarks for pricing, risk assessment, and fleet planning. Ultimately, the agreement underscores how manufacturer credibility and regional demand together shape the future of global aircraft leasing.

| Aspect | Current Insight | Impact on Leasing |

|---|---|---|

| Market Size | €370 billion by 2032 | Higher investment interest |

| Key Region | China | Stable long-term demand |

| Main Manufacturer | Airbus | Improved asset credibility |

| Leasing Preference | Operational flexibility | Lower airline risk |

Frequently Asked Questions (FAQs)

1. Why is the Airbus order from China important?

It strengthens confidence in aircraft values and long-term leasing demand.

2. How does this affect the aircraft leasing market?

It improves credibility, financing conditions, and global lessor confidence.

3. Why do airlines prefer leasing over buying?

Leasing offers flexibility and reduces heavy upfront capital costs.

4. What is the projected size of the leasing market by 2032?

The market is expected to reach around €370 billion.